Introduction

Starting your investing journey can feel overwhelming, especially with so much advice floating around. But smart investing isn’t about doing everything perfectly from day one—it's about knowing what to avoid as much as knowing what to do.

Here are five common mistakes beginners make, and how you can steer clear of them:

Jumping in Without a Plan

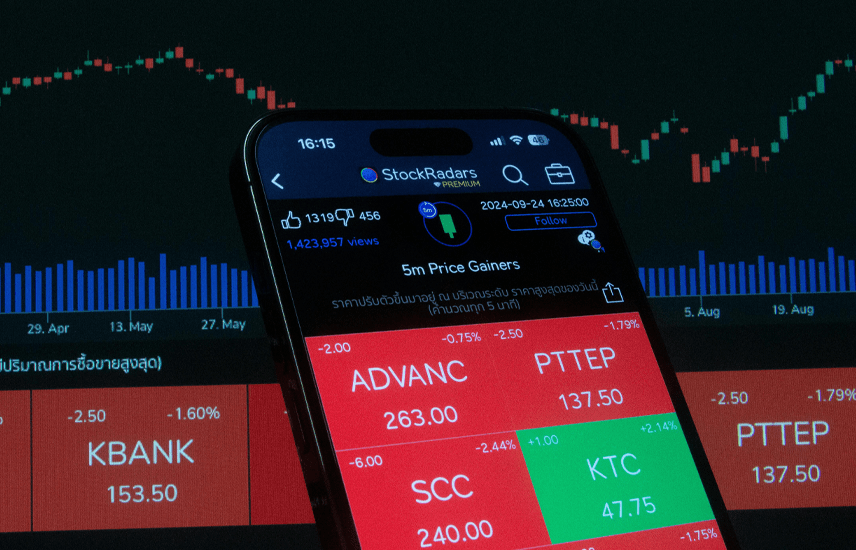

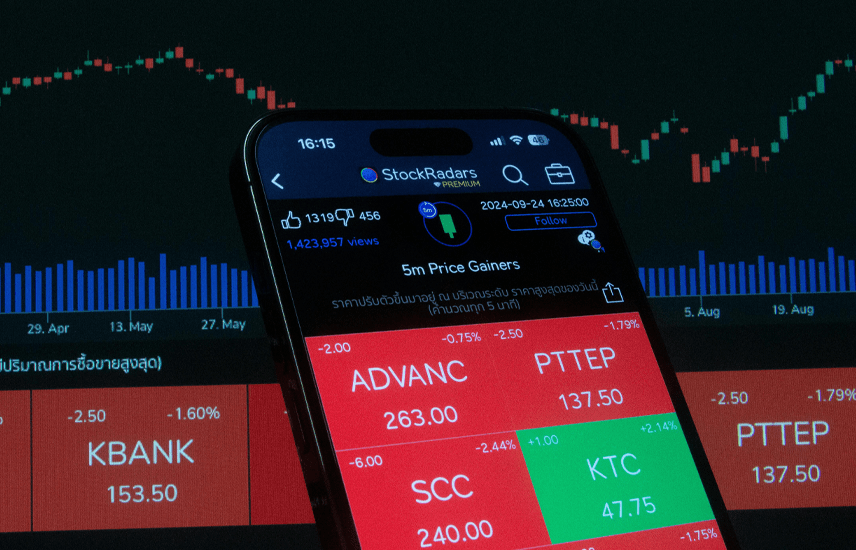

The Mistake: Many first-time investors buy assets randomly, following trends or social media tips without understanding why.

How to Avoid It: Before investing, set clear financial goals. Are you investing for long-term growth, retirement, or short-term gains? Create a basic strategy and stick to it.

Ignoring Risk Levels

The Mistake: Putting all your money into one high-risk asset because it looks like an easy win.

How to Avoid It: Understand your risk tolerance. Spread your investments (diversify) across different assets. Balance safer options with growth-focused ones to avoid unnecessary stress or losses.

Trying to Time the Market

The Mistake: Waiting for the "perfect" time to buy or sell can leave beginners stuck, doing nothing.

How to Avoid It: Focus on consistency instead of perfection. Regular, disciplined investing—sometimes called systematic investing—often beats trying to predict market ups and downs.

Overlooking Fees and Costs

The Mistake: Forgetting to check for hidden fees, brokerage charges, or taxes can quietly eat into your profits.

How to Avoid It: Read the fine print before investing. Use platforms with transparent fee structures and consider long-term costs, not just immediate returns.

Letting Emotions Control Decisions

The Mistake: Selling in a panic when the market drops, or buying impulsively because everyone else is.

How to Avoid It: Stay calm and stick to your plan. Markets naturally rise and fall. Disciplined manual investing is about patience, not reacting emotionally to every change.

Final Thoughts

Investing isn’t about avoiding every mistake—it’s about learning, staying consistent, and making smarter decisions over time. If you’re just getting started, keep these five common pitfalls in mind, and remember: steady, informed investing leads to long-term wealth.